Brokers: Evolution or extinction?

5th January 2017Increasingly irrelevant to the buy-side and inefficient for the sell-side, traditional broker relationships based on written research and phone calls are fast dying out.

Research shows active managers are turning to quantitative techniques and digital delivery techniques in response; fund managers and brokers that can’t adapt will not survive.

94% of the fundamental and quantitative fund managers, responsible for a total of $609 billion in assets, interviewed by Market Structure Partners, said that they expect funds using quantitative techniques to continue to increase in popularity.

94% of the fundamental and quantitative fund managers, responsible for a total of $609 billion in assets, interviewed by Market Structure Partners, said that they expect funds using quantitative techniques to continue to increase in popularity.

The research, sponsored by TIM Group, also found more than half of the respondents ignore 50% or more of their broker emails and phone calls, and also more than half of respondents valued broker research “not at all” or “a little.”

Given this, if the sell-side is to survive, leaders in brokerages must respond now. Quantitative managers have led the way in redefining service requirements and brokers must learn from this; adapting their offerings to the next wave of active managers that use quantitative techniques. What’s more, this evolution will happen during 2017 to maintain relevance post-MiFID II.

Whilst participants interviewed were near unanimous in their view that quantitative strategies or the use of quantitative techniques would increase in popularity, it is not a given that investment managers will be interested in even digital broker input. 44% of participants already source data from outside the broker community.

Buy-side assessment of brokers

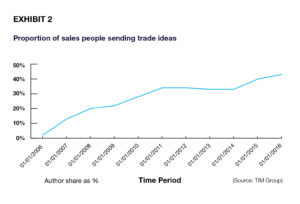

The focus on quantitative techniques is driving buy-sides to adopt proprietary and third party technology that can track, audit and measure the virtual performance of every recommendation or data item that a broker provides, whilst also measuring the broker input against other data sources. Statistics from our own platform (TIM), show a significant shift towards salespeople generating electronic trade ideas.

Such quantities of trade ideas, combined with the platform’s ability to provide a consensus view of the market (the sentiment indicator), means TIM Group is seeing an increasing number of buy-side firms turning to third party tools (like TIM) for the data feeds that they need.

More than just ideas

Away from the buy-side’s increasing appetite for a diverse suite of investment recommendations today, there is a degree of concern around accessing such recommendations in the future. Trade ideas and research must be paid for under MiFID II, or it is classified as an inducement. 39% of those interviewed were unsure of their ability to maintain access to investment ideas post MiFID II. A further 12% only had a degree of confidence in their ability to sustain full access to broker investment ideas in the future.

In the post-MiFID II world it is difficult to imagine how research could be provided without some form of automated, auditable tracking and payment process. This will mean that the buy-side will (very soon) have an increasing need for a facility that offers real-time gate-keeping and management of processes.

At TIM Group we are already responding to this – developing solutions in TIM that support different regulatory regimes. This means that the buy-side not only gains access to a suite of ideas, but can have confidence that the system is supporting them in complying with the law.

The evolution of the broker

Buy-side managers across the spectrum of investment styles will be compelled to think about how to use new data sources with their traditional strategies and thus digitalise processes and relationships.

We are already seeing increasing expenditure on technology on the buy-side. Some asset managers are investing heavily in improved quantitative techniques and data processing, as well as applying machine learning to a wider universe of assets.

Those asset managers who understand this change in culture and the investment in the right people and technology will pull ahead of the pack, taking the brokers who understand this shift with them.

References

This post is based on the latest whitepaper research: ‘Investment recommendations go digital’ by Market Structure Partners, sponsored by TIM Group. The research saw co-authors Niki Beattie, Managing Director at Market Structure Partners, and Rebecca Healey, an industry research analyst, interview participants on the buy and sell-sides, as well as international regulatory bodies, to understand the trends shaping the changing buy and sell-side relationships and how investment recommendations will be delivered in the future.